Table of Contents

*This story covers the NextBillion.ai pricing revamp from the Pay-as-you-go pricing model to the Bundled Pricing model.

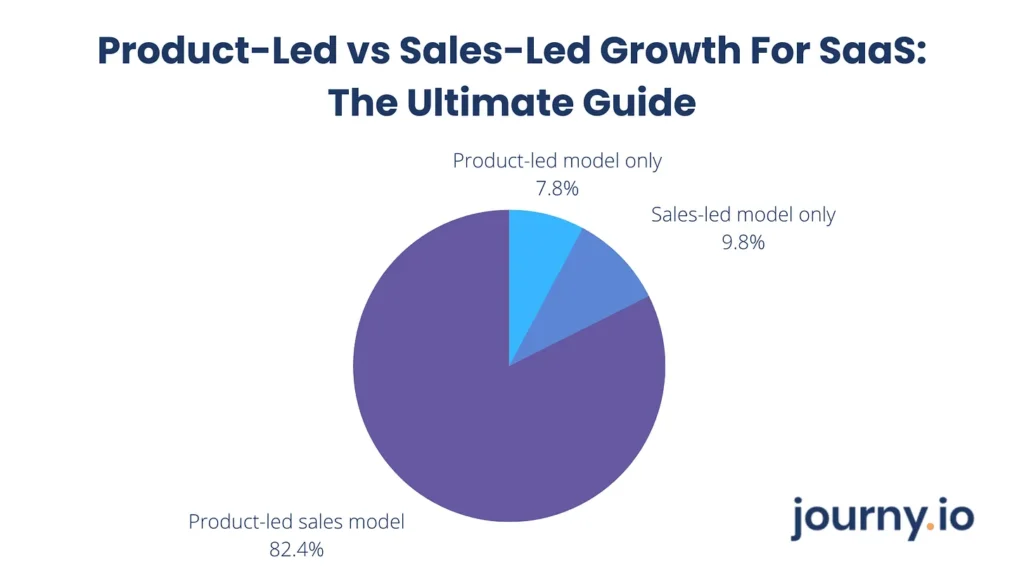

Very few factors impact a SaaS business’s success as much as its Pricing does. It has been found that SaaS businesses spend no more than 6-hours in their lifetime on their pricing structure.

Not dedicating sufficient time to its pricing strategy makes it even more essential to look into how companies plan to bill their customers and the outcome that comes from it.

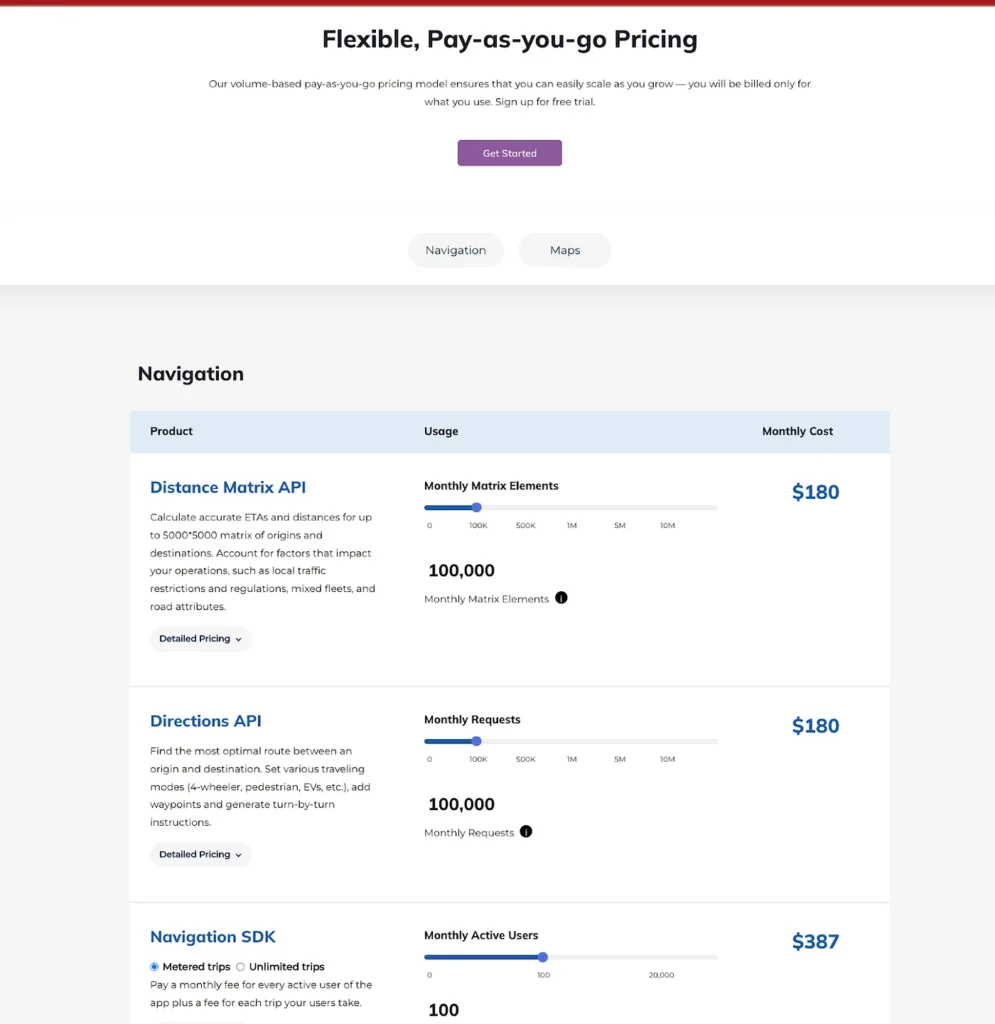

NextBillion.ai, like its peers, started with a Pay-as-you-Go pricing model, along with Tier-based pricing.

Why the Pay-As-You-Go pricing strategy made absolute sense

- As an early-stage Start-up, this gave our customers the flexibility to pay only for the APIs they have used.

- The prices dropped significantly at higher volume with Tier-based pricing. Helping us convert big-ticket clients easily.

- It helped in winning the pricing battle against the competitors. The pricing was low and the offerings better, making NextBillion.ai an obvious choice for the Location technology.

- It came with a high value of flexibility, scalability, and unique features.

At the outset, The Pay-As-You-Go pricing strategy perfectly aligned with NextBillion.ai’s goals and made sense.

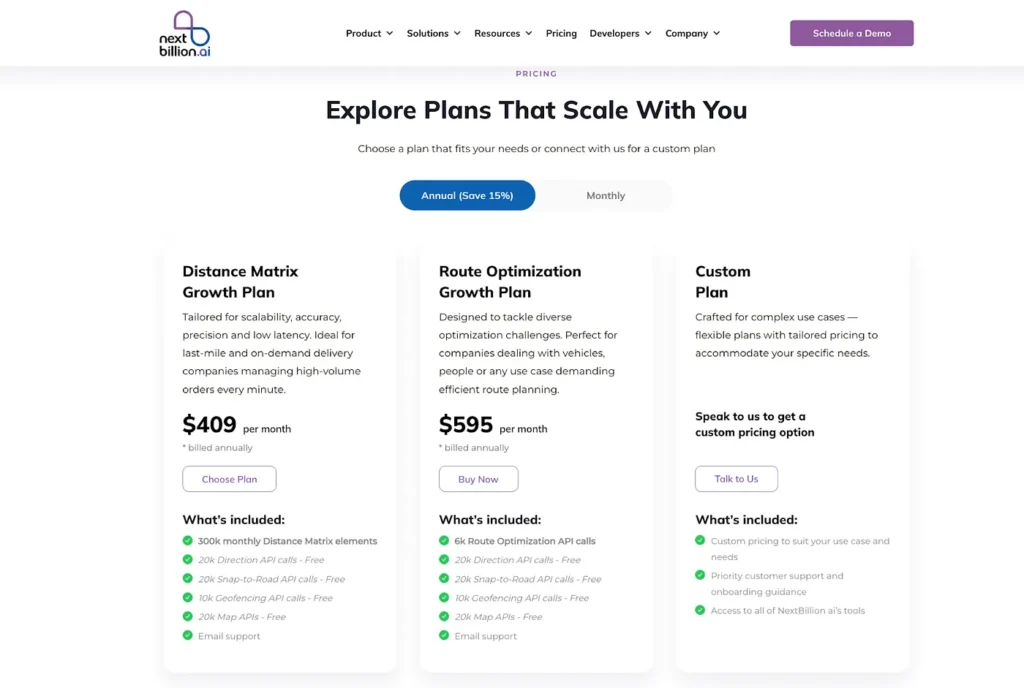

The Shift to Bundled Pricing — A Strategic Move

For anyone who is not familiar with bundled pricing. It is a pricing model where individual products are bundled at a discounted price that might not be available individually. For example, McDonald’s Meals is an excellent example of bundled pricing, where many products are offered at a comparatively lower price when bought together.

As the NextBillion expanded its product lineup and the customer acquisition over the next few months.

Over the period, as a location technology business, it also became clear that we needed to focus on fewer industries. (Read why NextBillion.ai started focusing on fewer industries.)

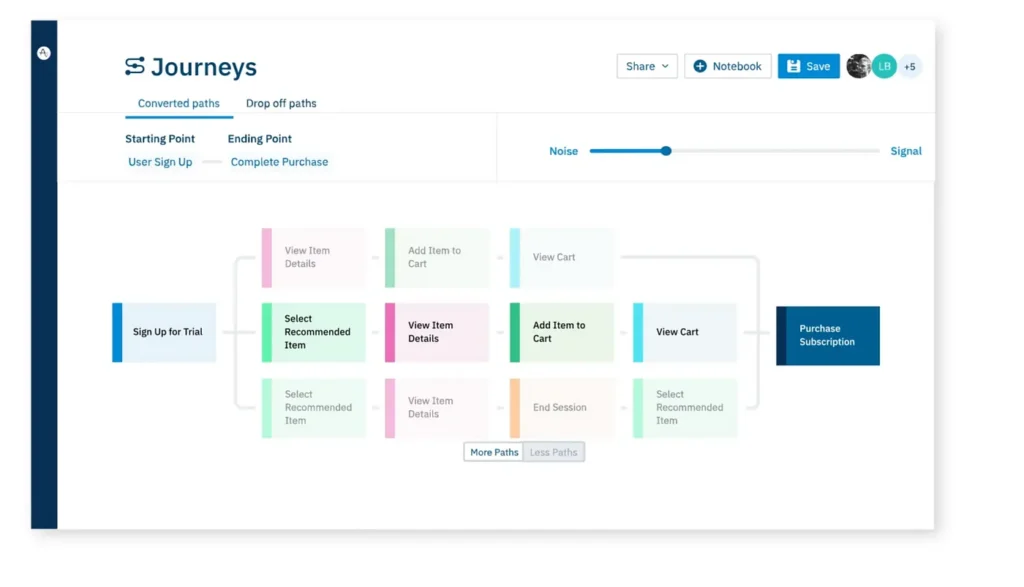

We started deep-diving into every customer persona and use case by analyzing buying patterns and listening to every customer’s calls.

The data showed that most customers frequently requested similar services (APIs) together.

Hence, shifting from PAYG to a Bundled pricing model made sense.

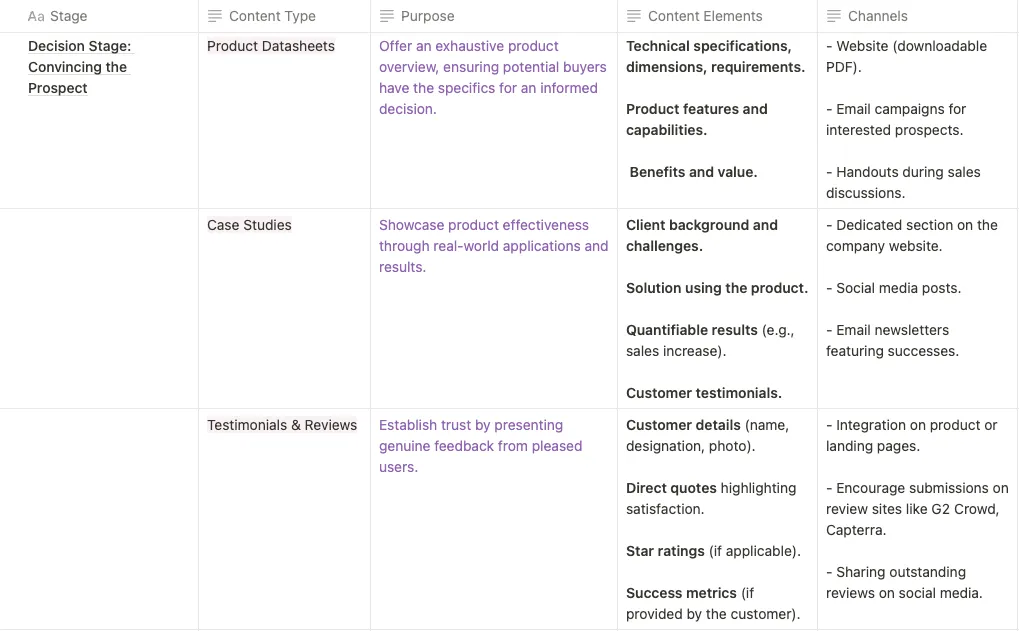

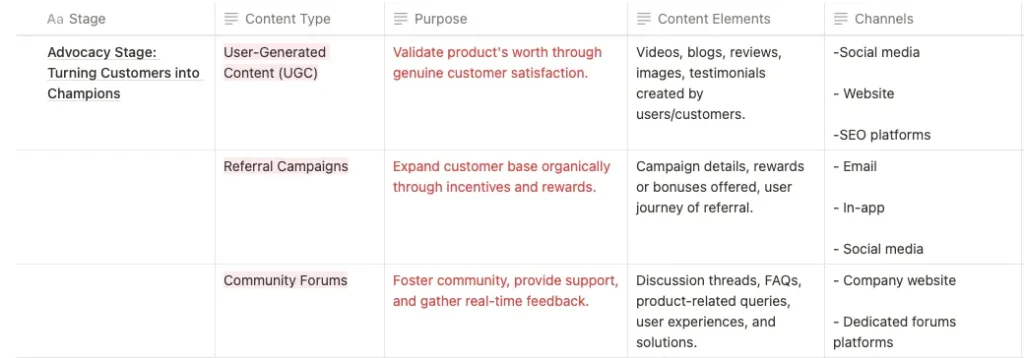

Several other strategic reasons compelled this Pivotal change –

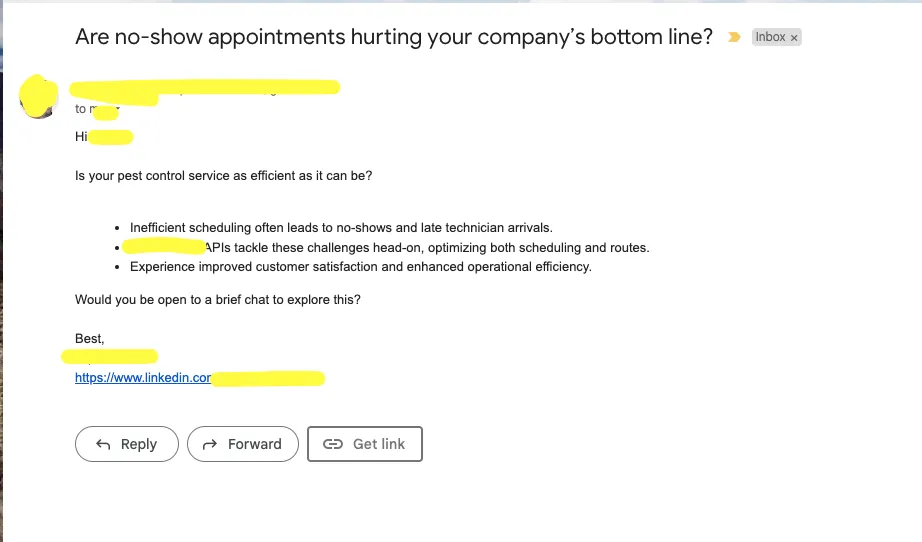

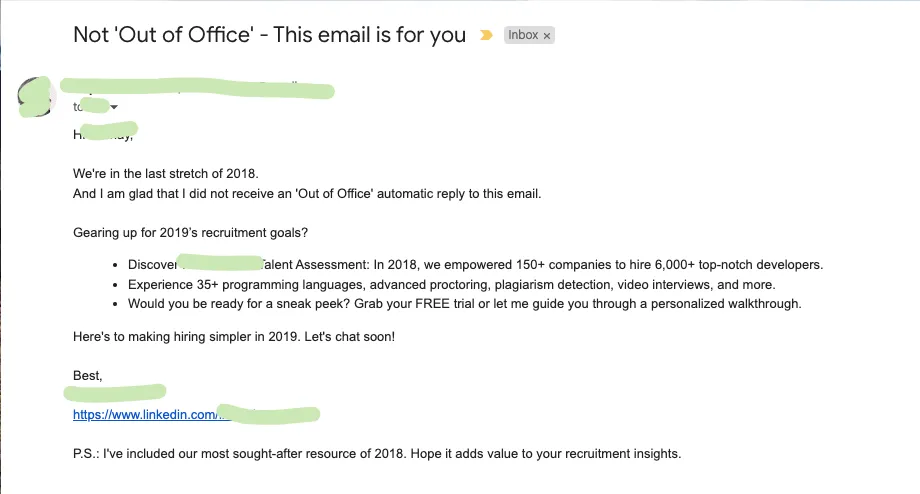

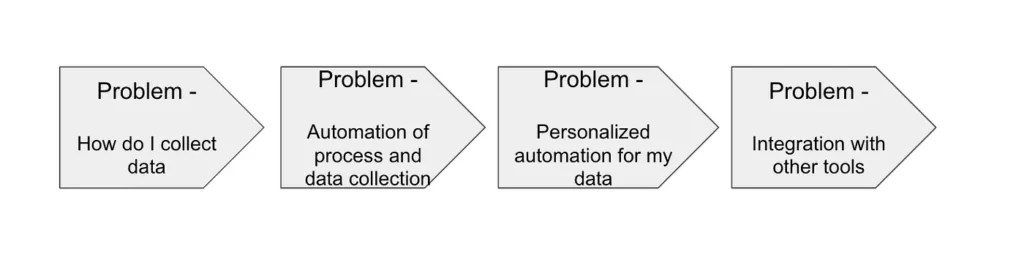

- Market Maturity — The targeted industry has evolved and matured. The prospects had absolute clarity about their business requirement and the APIs they would need — bundled pricing simplified sales strategy by offering a predefined package that resonated with market sophistication.

- Predictable Revenue Stream — Like every other Pay-As-You-Go SaaS business, revenue predictability took a lot of work despite a growing user base. Specific industries using location technology have a seasonal dependency, often leading to low API consumption. Bundled pricing aimed to create a more stable and predictable revenue stream.

- Targeted Industry — NextBillion.ai has been spreading its efforts across multiple industries. With bundled pricing, the organization started focusing on specific sectors where the bundles would be the perfect fit. This targeted approach led to improved sales and marketing effectiveness and efficiency.

- Reduce Churn — Most customers appreciated the clarity and value of bundled pricing. The lock-in effect helped businesses retain customers for a longer time.

Outcomes of Bundled Pricing

With some initial apprehension, we released bundled pricing. Over the next three months, we closely monitored our lead volume, existing customer usage, and sales calls. Apart from a few tiny user bases, there were no significant push-backs from any of our users.

Here are the learnings we had after five months of using bundled pricing strategy –

- Filtered Lead Volume — The startup experienced a shift in lead generation. At the same time, the sign-ups via students or early-stage start-ups dropped initially. The bundled pricing attracted more genuine leads who were interested in product offerings.

- Showcasing Value — Bundled pricing gave us a platform to showcase the breadth of products and services that NextBillion.ai can offer its prospects. Straightforward product bundling also helped us quickly compete with the smaller players in the European and North American regions.

- Revenue Predictability — One of the significant advantages we had with Bundled pricing was the newfound revenue predictability. This stability allowed the team to focus more on resources where it needed the most.

- Simplified Customer Experience — With market analysis and a deeper understanding of our target audience, we realized that our two flagship products were central to most bundles. Two primary bundles simplified the customer experience and facilitated purchasing decisions for our clients.

Bundle Pricing Framework Example

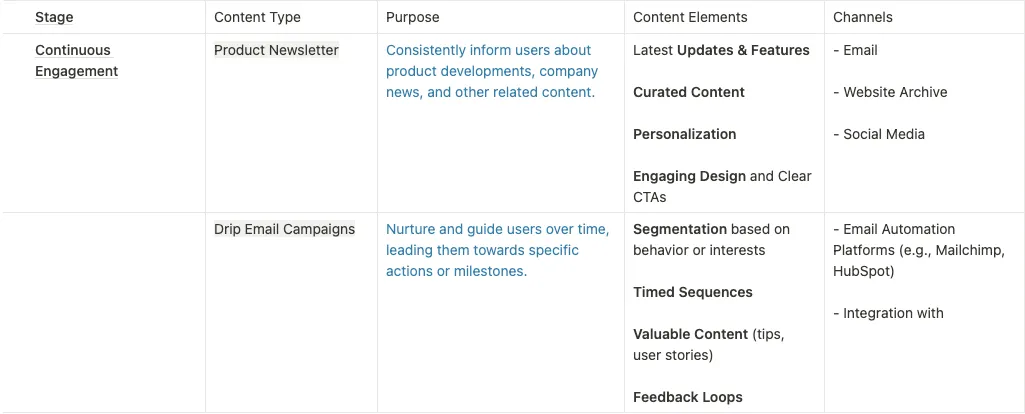

Moving from PAYG to bundle-based pricing requires a significant strategy shift in your business model. It requires careful planning and consideration of factors like market size, target audience, and existing customers for the execution.

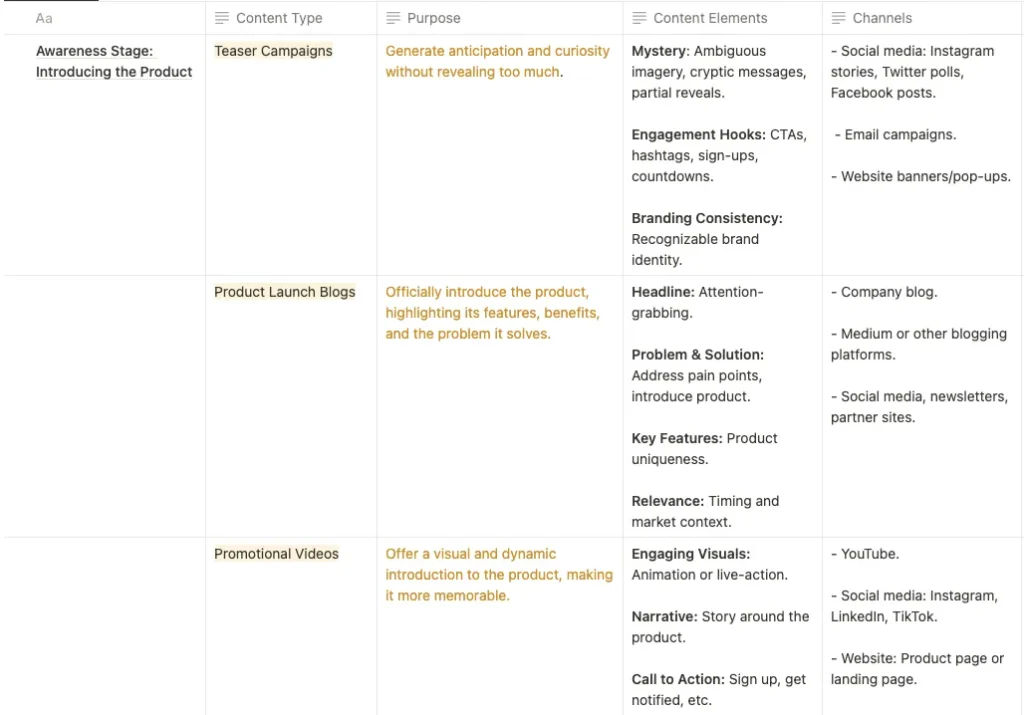

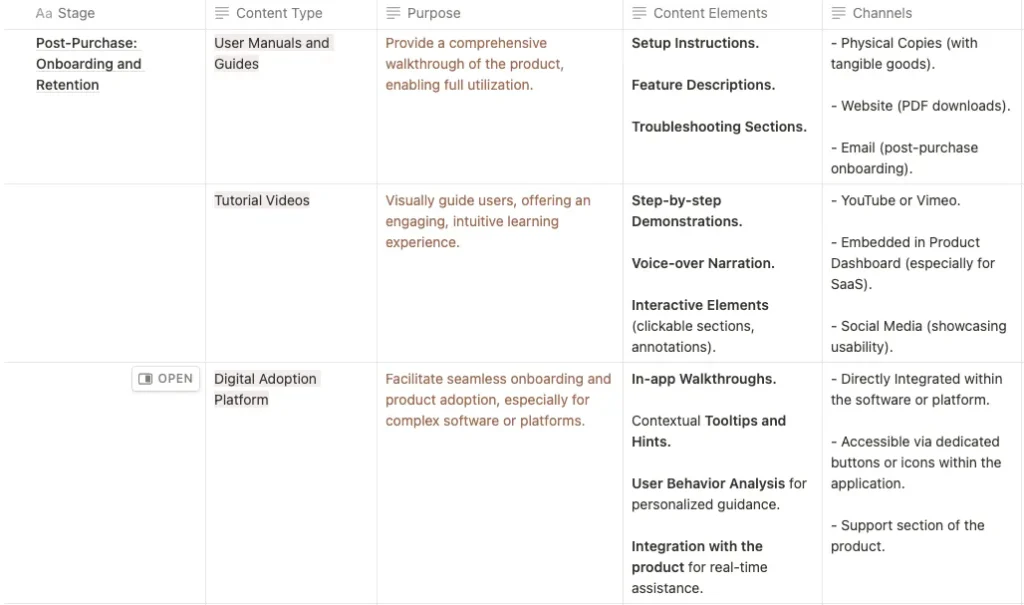

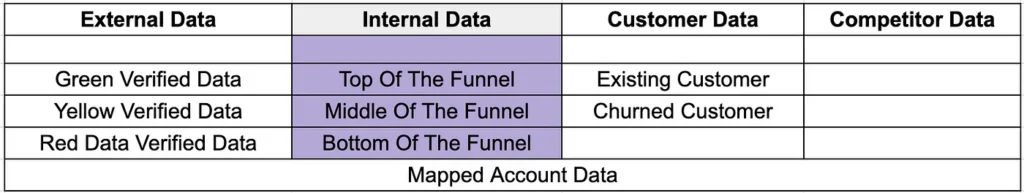

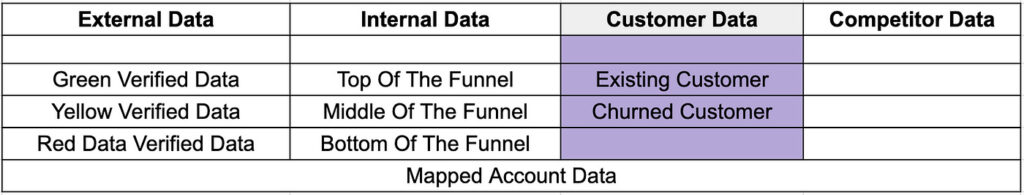

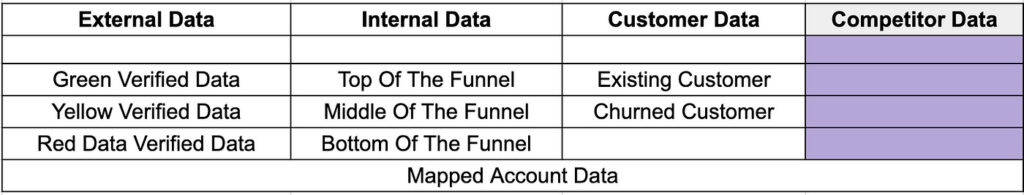

Here is a framework that we utilized for our pricing strategy –

Current Pricing Model — Understand and create a detailed document on the current pricing model. Here are some of the pointers which we covered.

- What is the usual API consumption?

- How are APIs charged?

- What is the infrastructure cost?

- How are customers currently billed?

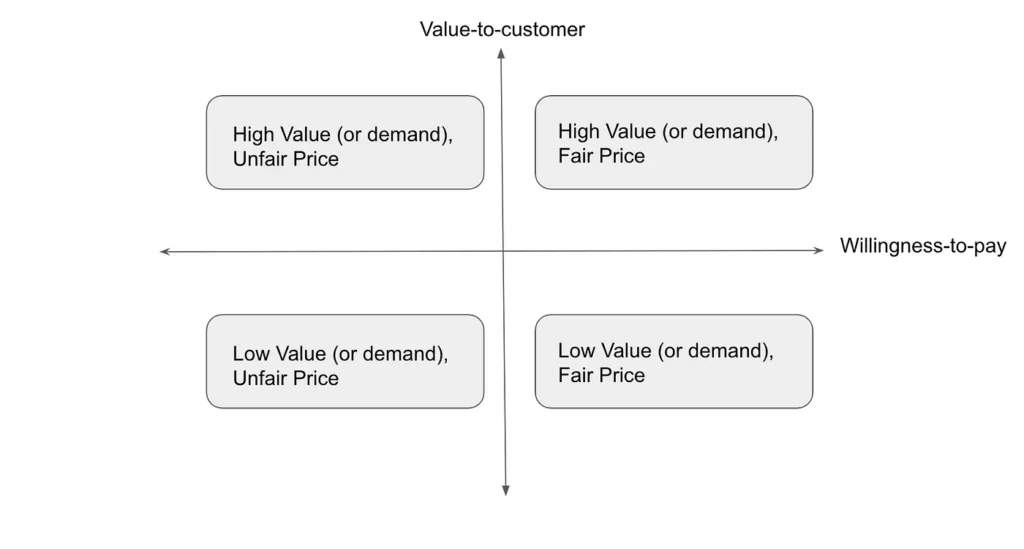

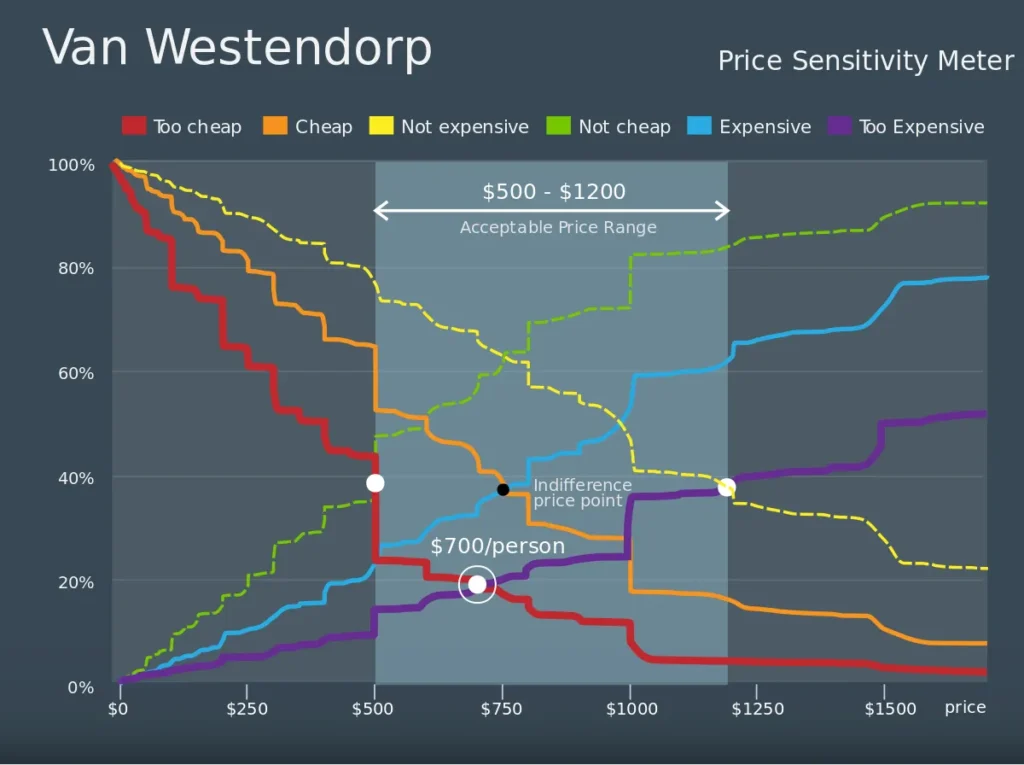

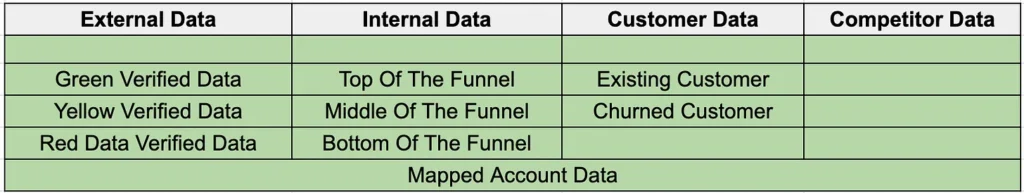

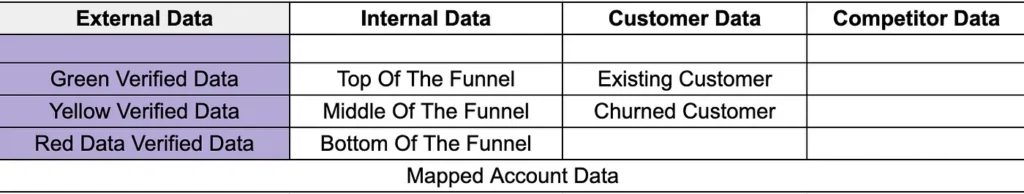

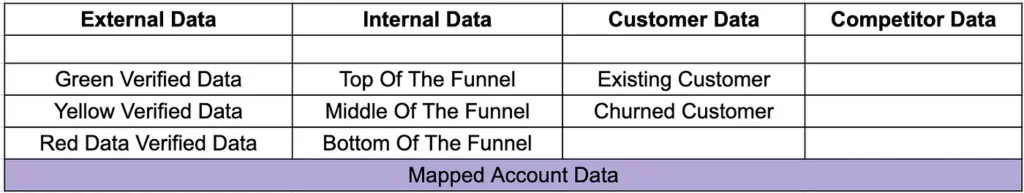

Identify Customer Segment — Segment your customer based on Industry, usage pattern, requirements, and willingness to pay. A clear customer segment would help bundle the product based on customer needs, industry, and requirements.

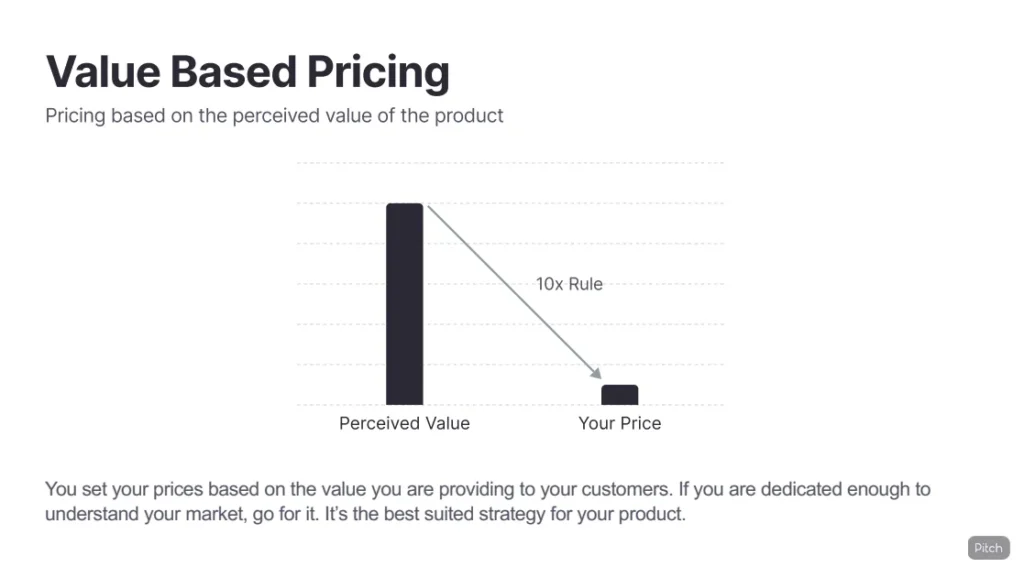

Determine Value Metric — Determine the critical value metric that matters most to your customers. It could be price, volume, or complex features. Ensure to include these key metrics when bundling your product.

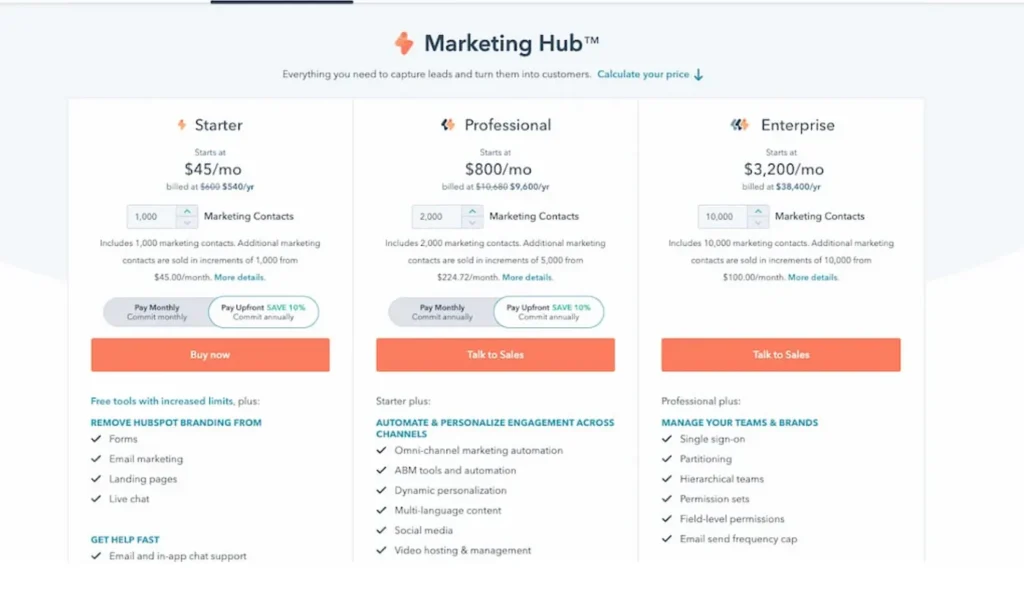

Design Bundle Plans — Create plans per your business personas for various segments, industries, and users. Consider offering multiple tiers and bundles that align with your prospects and users. Each plan should have a clear set of products, features, and limits.

Pricing Tiers and Features — Clearly define any pricing tiers for your bundle. Be transparent about what customers get in each tier, including features, support, and restrictions.

Pilot Program — Before fully transitioning to a Bundle pricing model, run a pilot program with a subset of your customers. Gather feedback and suggestions data to make necessary changes to your pricing.

Communicate — Communicate the new pricing to your customer through multiple channels. Clearly explain the transition’s reason, the associated benefits, and further billing process. Give ample time for your customers to consider and resolve all feedback and queries on priority. Develop clear strategies to retain customers who might be hesitant about the pricing change.

Monitor and Iterate — Continuously monitor prospect calls and keep the conversation with sales open. Take regular feedback and follow up on deal closure. Be ready to iterate your plan and pricing if needed.

Legal and Compliance Considerations: Ensure your new pricing complies with all legal or regulatory requirements. The laws may differ for each, especially if you have clients across different countries.

Measure Success — Have clear Key Performance Indicators (KPIs) to measure the success of the new bundled pricing. It could be customer acquisition rates, shorter sales cycles, revenue growth, or customer satisfaction scores.

Conclusion

Remember, transitioning from one pricing model to another is a significant change, and adopting the new pricing may take significant internal and external time. Responsiveness and a feedback loop are essential to make the Bundle pricing strategy successful.

In conclusion, NextBillion.ai’s shift from the PAYG pricing model to bundle-based pricing was driven by revenue predictability, market maturity, target industry, and churn.

This shift brought positive outcomes to the business in terms of filtered leads, revenue predictability, and simplified customer experience.

As the startup continues to evolve, its customized solutions and negotiation flexibility keep it on a path to growth and success in the dynamic world of technology startups.

![9 steps to create a Sales Battle Card [+6 Free templates]](https://nextvant.com/wp-content/uploads/2026/02/9-steps-to-create-a-Sales-Battle-Card-6-Free-templates-NextVant.jpg)